I think a lot about how we’ll manage the cash flows at Little Seed during the first few years of operation. It’s an extremely important topic because it can literally make or break your business... no matter how well you appear to be doing. Fast growing, seemingly profitable companies go under all the time and the culprit is typically poor cash flow management. One way to prepare for (and hopefully avoid) that unfortunate circumstance is to understand your fixed and variable costs. In this post I’ll cover what that means and how it can impact your business and in a later post I’ll expand into how it applies to various circumstances (debt load, working capital needs, etc).

So what the heck are fixed and variable costs anyway? No reason to let your head spin, it’s really quite simple. A fixed cost is exactly what it sounds like: it is a cost that remains pretty much the same no matter how high your sales are. These are costs that don’t change whether you sell 100 pounds of sausage or 1,000 pounds of sausage. Generally, the major fixed costs are interest expense (mortgage or bank note payments), insurance payments, fuel expense (in certain instances, like trips to farmers market), marketing/website expenses, etc.

Variable expenses are those things that do change as your sales climb higher. In farming, these are costs would include your feed expenses, slaughtering fees, packaging, etc. Labor is one of those funny expenses that is a little bit of both. While it certainly takes more time, it probably doesn’t take proportionally more time to look after 10 pigs as it would 100 pigs. Since labor costs won’t increase proportionally, they are considered a partially fixed cost. Depreciation expense is also partially fixed in most cases, so you’ll have to make some assumptions on certain expense categories and break them apart appropriately based on your circumstance and estimates.

Once you have your costs roughly broken down into those two categories it is helpful to understand whether you can cover your fixed costs after already accounting for your variable costs. Map out your financial plan and include all your projected sales and then subtract your variable expenses only. Does that leave you with enough profit to cover your fixed costs? If not, you’ll need to do one of three things: charge a higher price, produce a higher volume or figure out a way to reduce your costs.

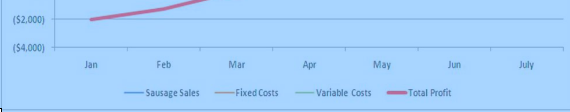

Lets take the sausage example. In one month I produce 100 pounds of sausage and sell for $6 per pound, for total sales of $600. I estimate my variable costs account for 50% of my total sales dollars, or $300. That leaves me with $300 of profit to cover my fixed costs. It’s highly likely that my fixed costs are much higher. Insurance alone is a few hundred a month. Phone bills, mortgage payment, tax payments and other fixed costs will easily tack on a few hundred (or thousand) more. Maybe total fixed costs in this instance are $2,500 per month. So at 100 pounds per month I’m in the hole $2,200. Not so good!

It seems pretty obvious that an increased production volume is necessary. You could ratchet up the price a bit, but you’ll be trying to sell more volume and the reality is that to push a lot more volume you probably won’t have the luxury of raising prices. There might be ways to cut some production costs, but finding new sales outlets seems like a good strategy. So the next month I get to 1,000 pounds and I sell it all at $6 per pound. Now I have $6,000 in total sales, $3,000 in variable costs (because they increase in proportion to sales) and now I have $3,000 left to cover fixed costs. Assuming my fixed costs remained at $2,500 I now have a tidy $500 profit. This is called leveraging your fixed costs and it’s one of my favorite things! Yeah, I’m a geek, but geeks will inherit the earth, right?

For a small, family farm these are important considerations. This type of analysis gives a rough idea of the required scale to stay profitable. You may earn enough to feed and take care of the animals, but if you can’t cover your insurance and other fixed costs then there’s a problem. Hopefully by analyzing your fixed and variable costs you’ll be able to better understand the optimal balance between size and profitability for your business!

So what the heck are fixed and variable costs anyway? No reason to let your head spin, it’s really quite simple. A fixed cost is exactly what it sounds like: it is a cost that remains pretty much the same no matter how high your sales are. These are costs that don’t change whether you sell 100 pounds of sausage or 1,000 pounds of sausage. Generally, the major fixed costs are interest expense (mortgage or bank note payments), insurance payments, fuel expense (in certain instances, like trips to farmers market), marketing/website expenses, etc.

Variable expenses are those things that do change as your sales climb higher. In farming, these are costs would include your feed expenses, slaughtering fees, packaging, etc. Labor is one of those funny expenses that is a little bit of both. While it certainly takes more time, it probably doesn’t take proportionally more time to look after 10 pigs as it would 100 pigs. Since labor costs won’t increase proportionally, they are considered a partially fixed cost. Depreciation expense is also partially fixed in most cases, so you’ll have to make some assumptions on certain expense categories and break them apart appropriately based on your circumstance and estimates.

Once you have your costs roughly broken down into those two categories it is helpful to understand whether you can cover your fixed costs after already accounting for your variable costs. Map out your financial plan and include all your projected sales and then subtract your variable expenses only. Does that leave you with enough profit to cover your fixed costs? If not, you’ll need to do one of three things: charge a higher price, produce a higher volume or figure out a way to reduce your costs.

Lets take the sausage example. In one month I produce 100 pounds of sausage and sell for $6 per pound, for total sales of $600. I estimate my variable costs account for 50% of my total sales dollars, or $300. That leaves me with $300 of profit to cover my fixed costs. It’s highly likely that my fixed costs are much higher. Insurance alone is a few hundred a month. Phone bills, mortgage payment, tax payments and other fixed costs will easily tack on a few hundred (or thousand) more. Maybe total fixed costs in this instance are $2,500 per month. So at 100 pounds per month I’m in the hole $2,200. Not so good!

It seems pretty obvious that an increased production volume is necessary. You could ratchet up the price a bit, but you’ll be trying to sell more volume and the reality is that to push a lot more volume you probably won’t have the luxury of raising prices. There might be ways to cut some production costs, but finding new sales outlets seems like a good strategy. So the next month I get to 1,000 pounds and I sell it all at $6 per pound. Now I have $6,000 in total sales, $3,000 in variable costs (because they increase in proportion to sales) and now I have $3,000 left to cover fixed costs. Assuming my fixed costs remained at $2,500 I now have a tidy $500 profit. This is called leveraging your fixed costs and it’s one of my favorite things! Yeah, I’m a geek, but geeks will inherit the earth, right?

For a small, family farm these are important considerations. This type of analysis gives a rough idea of the required scale to stay profitable. You may earn enough to feed and take care of the animals, but if you can’t cover your insurance and other fixed costs then there’s a problem. Hopefully by analyzing your fixed and variable costs you’ll be able to better understand the optimal balance between size and profitability for your business!

What are your biggest fixed costs in business or in real life? Sometimes it's helpful to think about these things on a personal level too. If you get a raise at work, don't go out and spend more, leverage your fixed costs and put some away in savings!