One thing we haven’t found a lot of information about online is the operating costs of running a small, homestead farm. Instead, we’ve visited a bunch of farms, thought long and hard about what we spend money on and slowly put together our own operating expense budget. We thought it would be helpful to share some of our findings and maybe provide some clarity for other beginning farmers. This is a long post, but there's no other way around it, it's not a simple subject to tackle.

What are Operating Expenses?

I define operating expenses as indirect expenses. They are ongoing costs that are not directly connected with with the final products you sell. Operating expenses are those costs that you incur independent of the product you are selling. Sometimes this area gets a little fuzzy and not everything is perfect, but for us we include things like fuel, electricity, insurance, mortgage payment, etc. In fact, those four that I just listed will most likely be 70-80% of our operating expenses. I do not include items like feed, hay, labor, minerals, vet bills, or butcher costs. I consider those to be direct expenses and think about them separately.

For a detailed overview of how and why I think about direct and indirect expenses separately please see Farm Flows - Understanding Gross and Operating Profit.

What are a Small Farm's Operating Expenses?

Needless to say, every farm's budget will look different. We plan to focus on raising livestock and producing cheese. If you are planning on growing veggies your budget will look different, but this could still be a decent guide. If you have kids your budget will look very different, but again, hopefully this is a good rough guide.

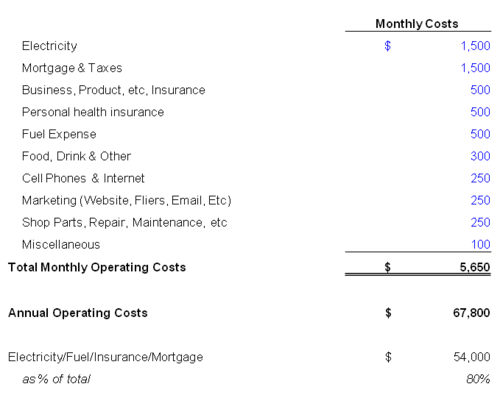

Here’s what a small farm's monthly budget might look like:

This is not our exact budget, and we have no idea what our expenses will actually look like, but I don’t think this is too far off-target for what many small farmers would face when operating at a reasonable scale. To be sure, the semi-variable components of this budget (fuel, electricity, insurance, etc) can be much higher or much lower (as can the mortgage), but we think this is a fairly conservative budget for smaller-scale farms.

If you leave a comment or post a note on our facebook page with your contact info I will be happy to email you this spreadsheet, although it's honestly as simple as it looks.

So what does this all mean for you?

These expenses are what you have to cover with the profit from your business AFTER all the direct expenses are taken into account. Labor, feed/seed bills, butchering costs and other expenses that are directly associated with your product will need to be covered in addition to your operating costs. This means you will need to plan on a high enough margin after your direct expenses to cover all the stuff listed above.

By including personal expenses like the mortgage, food and non-farm related expenses you can ensure that you're bringing home enough of a wage to cover your own expenses. If you want your farm to be your sole-source of income and be sustainable in the long-term it needs to cover the business' expenses AND provide a high enough salary for you to live the lifestyle you desire.

Similar to previous posts, I am not providing accounting advice. Including personal expenses on your business' tax return will get you into trouble. What I'm trying to do here is provide practical budgeting advice for a small, homestead farm. In my opinion, that requires taking into account your living expenses. Not everyone will agree with that, but that's ok, there's multiple ways to skin this cat.

More Detail on The Big Expenses

Let's tackle the big four first

Mortgage Payments

The easiest one will be your mortgage (and taxes). If you don’t already have a mortgage and want to find out what it would be you can use an online mortgage calculator to run various estimates. If you own your land outright, or you lease your land at a low rate, you dodge a huge expense on this one.

Insurance

To be honest, we don’t know what our insurance costs will be. We haven’t gotten quotes yet and we probably won’t until we know where we will be located and have an idea for what types of coverage we’ll end up needing. That being said, we have spoken with farmers all over the country about their costs. In general the feedback has been that personal insurance for a couple people will be about $300-$500/mo, give or take a hundred or two. Product liability and business insurance costs are all over the map, and we think $500 is reasonable for a smaller scale farm, but who knows what yours (or ours) will end up being.

Fuel Expense

Fuel expense is a combination of a lot of things. First, think about how much fuel you would use going to do customer drop-offs. This includes farmer’s markets, CSA drops, or any other fuel associated with getting the product to the customer. Then add in the fuel you will use going back and forth between the butcher shop. Add on to that any fuel you use getting around the farm, both on the tractor and in your trucks and cars. Don’t forget to include recreational car trips for stuff like going to the grocery store, taking the kids to school or whatever else you might be doing. I took a rough estimate of the total miles traveled per month, a high estimate of fuel cost per gallon, and a rough estimate for mpg and came up with about $300-$500 per month. It adds up!

Electricity

Electricity will be a monster expense for us because we’ll be freezing meat inventory, operating the dairy and creamery, and refrigerating rooms full of cheese. Your electricity expense will vary by location, equipment used and scale of your operation. It could be a tiny fraction of what's included in this budget. We polled around and came to a rough estimate for our scale of about $1,000 to $2,000 per month depending on the electricity cost in the area. I hope this is conservative, but it’s hard to know. We’ll be looking into grants for solar installations and even wind power, if possible. Electricity is an easily overlooked and underestimated expense, but it can be huge.

Other Big Expenses You Might Have

Equipment loans. If you borrow a bunch of money for a tractor, a new truck and all kinds of other stuff then you’ll have a big monthly payment going out the door.

Student loans. If you’re just getting out of school and have a bunch of debt you’ll have a big student loan bill.

Kids! Kids are expensive. We haven’t budgeted for them (yet!) because we don’t have any. You tell me how much those little buggers cost, I know I wasn’t cheap!

As you can see, the big four costs amount to about 80% of the total operating costs. If there’s any way to cut back on those expenses and not sacrifice your integrity or the integrity of your product then it’s probably smart to focus on that. Solar to help with electricity, alternative forms of distribution to help with fuel costs (i.e. selling by halves/wholes), creative insurance policies or higher deductibles, and potentially leasing land (or owning less) are all interesting ways to save on your biggest expenses.

Remaining Expenses

The rest of the stuff on the list is very dependent on where you live, what your lifestyle is like and all sorts of other considerations. One thing that was funny for me was that I totally forgot about FOOD expenses when I first planned our budget. That’s one of our biggest living expenses right now, but it totally slipped my mind when I was thinking about “being a farmer”. I guess in my brain I just figured farmers all fed themselves for free. Wrong!

Cell phones, cable, website fees, magazines, and all those day-to-day expenses really start to add up when you write them all down. I’ve gone through this “budgeting” exercise with lots of friends who need help with their personal finances. It’s always a huge shocker when people actually sit down to write it out. I've found it to be useful.

I'd be curious to get your feedback. Are there expenses I missed that are important to you?